Treasuries’ creepy calm

It has not been a particularly quiet spring and summer for the economy: the expectations of growth have fallen, inflation has occurred, the rate policy has been equalized and the president has lobed rhetorical hand grenades, and even worse, at the central bank and desk or Labor or Labor or Labor.

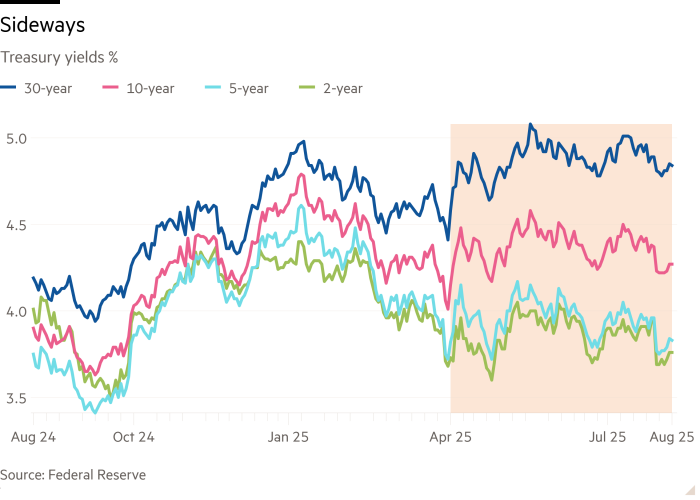

The treasury market seems to have ignored it all quietly. Going back to mid-April, the proceeds (2, 5, 10 and 30-year-old) are locked in a trade reach of 25 BP or 30bp. The very short and middle part of the curve is exactly where it was on April 8, and the 30-year-old is all from 13 BP higher:

In the meantime, the option-geomplicated Treasury volatility has fallen steadily for one, three and six months, as reflected in the index indices:

What to make of this?

Partially, the apparent calmness hides an uncomfortable impasse. The growth has come down, which should push the yields down, everything else is right. The expectations of inflation and inflation have risen, which should be done, everything else is right. The two can probably be canceled to a certain extent by canceling each other. To frame this numerically, since the first week of April, 10-year-old real rates (as produced by 10-year-old inflation-indexed revenues) has fallen with 17 basic points, but 10-year inflation expectations have risen by the same amount. And the FED is subtly balanced between its employment and inflation mandates. Under the calm surface of the bond market, powerful forces are in conflict.

It is also important, as Guneet Dhingra from BNP Paribas has been noted to remember the context. Things are better than they ever appeared, but that does not mean that they are good in absolute terms. Volatility of the bond market has been falling for months and is as low as it has been since 2022, but it is still well above pre-bidd levels. There is a big difference between “good” and “not as bad as previously believed”, but in markets they can look alike.

But if this somewhat gloomy economic image – a balance characterized by a little less growth and a little more inflation – is correct, why is the S&P 500 than 30 percent higher than the same four months? The cynical reading of this is that the stock market is euphoric, with a “buy the dip” mentality firmly in control. A more measured lecture would be that the majority of the work of the upright of the S&P is done by huge, super-profit technology companies whose income is not bound by the broader economic climate. It can be a combination of both.

The recent CPI inflation report was just hard enough to keep the bond market balance stable, just like the jobs report report was not bad enough to crack it. We hold our breath while the numbers of August arrive.

((Armstrong))

Data quality and the response rates of the research

President Donald Trump has nominated EJ Antoni, Chief Economist of the Heritage Foundation, a conservative think tank, to lead the Bureau of Labor Statistics. The critics of Antoni, and there are enough, point to his partisan bias and limited experience. On Tuesday morning these critics received some red meat, when Media -stores picked up the suggestion of Antoni that the BLS was suspended monthly job numbers. The coverage may have led to softness in the dollar:

Dropping monthly reports is a bad idea. Fewer releases would not lead to a better understanding of the economy. Yes, there are revisions in the early estimates, but those estimates still offer policy makers and investors useful information. The markets understand the trade -off between timeliness and accuracy. Too bad the White House doesn’t.

However, there is a core of truth in the argument of Antoni. “The environment of data collection becomes more difficult and every answer requires more resources,” says Joanne HSU at the University of Michigan, who manages the research of the university confidence. If the BLS no longer receives resources, timeliness or accuracy must be sacrificed.

But, as HSU notes, something is lost in this debate. Many experts – including not –igrated – have stopped the falling response rates on the current population survey (basis of the unemployment rate) and the current employment research (the wage lists) and, if not the, most important cause of the falling quality of the American task numbers.

That’s not quite right. The most important care in falling response rates is that they can introduce non-response prejudices. If people from a certain demography do not respond, it introduces disruptions in the data. If young people have less chance of, for example, to answer the phone, the data would not be representative of the entire population of working age.

The answers from the survey have decreased in the developed world, but several study to have The falling response percentages shown have not resulted in large prejudices. That may be because the populations investigated are still representative, or because the BLS and other government agencies do good work to chase answers and adjust their models. The data remains of high quality for now.

But the less and less survey there are, the more difficult the agency will have to work to ensure that the results are accurate. More money will be needed to hire people to detect reactions and to ensure that the employment image is accurate, grainy and detailed. Otherwise the revisions will be even bigger. “The entire point of the revisions is to improve the estimates of the survey,” said Brady West, a research methodologist at the University of Michigan and a former BLS advisor.

If Antoni is appointed and the resource challenge does not take seriously, the US economic data quality will fall.

((Repeat))

One well read

Ft unhowded podcast