Unlock the Digest of the editor for free

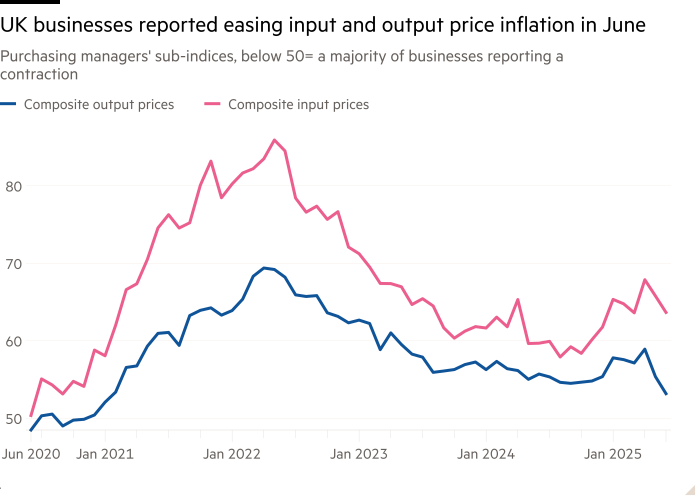

The increase in the average prices charged by British companies was the slowest in more than four years in June, because companies continued to shed and the economic activity remained modest, according to a close study.

The S&P Global Flash UK PMI index of the monthly growth of companies fell to 53.2 in June, from 55.4 in the previous month, the lowest since January 2021.

The last lecture was well under a peak of almost 70 registered in 2022 and was almost 50, which indicates no change, and was able to strengthen the case for the Bank of England to further reduce the interest rates during the next meeting in August.

“Rate-Setters will be relieved to see that the ‘terrible April’ of indexed and government prize stages, payroll taxes and a large leap in the minimum wage to date demonstrate limited persistence,” said Elliott Jordan-Doak, economist at Pantheon macroeconomic substances.

He said that relieving output price growth was consistent with the inflation of services that delayed 4.7 percent in May to a projected 3 percent in six months.

The data “should reassure the bank that it can continue to reduce interest rates at the current pace of a 25 -basic points reduction per quarter”, as he drops employment, he added.

Markets are divided on whether the BOE will lower the rates of 4.25 percent during the next meeting on August 7, after having kept stable in June. Since the summer of 2023, the BOE has delivered four tariff reductions.

The survey, conducted from 12-19 June, also showed the input costs slower, but still the output prices, which indicates little evidence of higher energy prices that increase input prices.

The Headline Composite Output Index of the survey, a benchmark for monthly growth in the private sector, only rose marginal to 50.7 in June of 50.3 in the previous month.

“At the end of the second quarter, the British economy remained in a slow condition,” said Chris Williamson, main business economist at S&P Global Market Intelligence.

He said that the lecture was consistent with GDP growth that increased by 0.1 percent in the second quarter, a clear delay of the 0.7 percent registered in the first three months.

Employment fell for the ninth month in a row, because manufacturers reported a new fall in overseas orders, linked to American rates and geopolitical uncertainty.

“Although the composite PMI of June is consistent with the GDP flatlining in Q2, the Bank of England will reassure that the recent cooling on the labor market ultimately seems to weigh the prices of services,” said Alex Kerr, economist at the Consultancy Capital Economics.