The same issues that led the founders to explain independence of the crown in 1776 brought 77 million Americans to the polls in 2024: heavy taxes, weak leadership and an other accessible government numb the needs of its citizens. President Trump won in a landslide victory by offering powerful solutions to each of these problems. He is the American statement of independence of business as usual in Washington.

The president wants to serve ‘the forgotten men and women of America’. And the only large, beautiful account, which he signs today in law, is central to that mission. This historical legislation will make life more affordable for all Americans by releasing parallel prosperity – the idea that Main Street and Wall Street can grow together.

New projection indicates good news for families, employees in Trump’s ‘Big, Beautiful Bill’

The only large, beautiful bill represents the priorities of the new Republican Party, including millions of Americans in the working class that once called themselves Democrats. This bill builds on the Blaasia Renaissance started by President Trump.

Since the President Trump took office in January, the wages of the core have risen by 1.7%. This represents the biggest rise in the wages of the working class to start a presidency in more than 50 years. For comparison, the wages of the working class fell among each president for the same period since Richard Nixon with only one exception President Trump in his first term.

Treasury Secretary Scott Bessent believes that President Trump’s ‘One Big, Beautiful Bill’ will unleash an economic flowering. (Getty images/photo illustration)

The key to fueling the second blue tree of the president is his efforts to put an end to illegal immigration. The open policy of earlier administrations accelerated the affordability crisis of our nation. The influx of millions of illegal alien beings has untenable pressure on health care, housing, education and well -being. It also supported a black market in labor that had been suppressing the working class wages for decades. But that ends with one big beautiful account.

The only big great account is more than just a tax assessment. It works to ensure that illegal immigrants do not use the safety net created for Americans. The bill also finances the completion of the border wall and offers means to hire thousands of extra federal agents to protect our country against future illegal immigration. The goal is to deduct the estimated $ 249 billion annual wage Paid to illegal employees to legal employees and American citizens. The termination of the black market of labor without papers by financing our existing immigration laws will lead to an enormous wage increase for the working class.

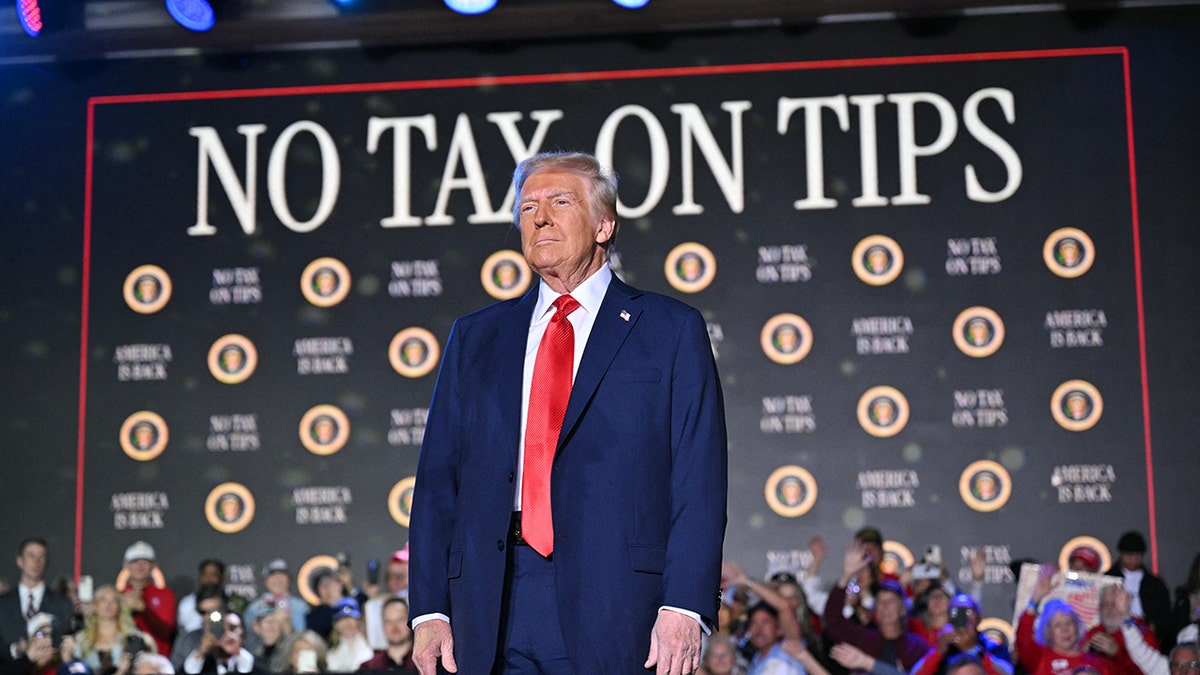

US President Donald Trump arrives to talk about his policy to terminate the tax on tips in Las Vegas, Nevada, on January 25, 2025. After visiting Ramplocations in North Carolina and California, the Vegas-Stop is more a feel-good victory round, because he explains his plans for tips in a city of tips out to be out of an out of a tips to be out of an out of a tips to be out of an out of tips to be out of a city in a city to be out of a city of tips out of an out of tips in a city of tips in a city of tips. City industry. (Mandel Ngan/AFP via Getty images)

We have previously seen American employees of the president’s economic approach. Under President Trump 2017’s tax cuts, the assets of the lower 50% of households increased faster than the capacity of the top 10% of households. That will happen again under one big beautiful account.

The bill prevents a tax increase of $ 4.5 trillion for the American people. This allows the average employee to keep an extra $ 4,000 to $ 7,200 in annual real wages extra and allow the average family of four to retain an extra $ 7,600 to $ 10,900 in Take-Home Pay. Add to this the ambitious deregulation agenda of the president, who could Save the average family of four an extra $ 10,000. For millions of Americans, these savings are the difference between being able to make a mortgage payment, buy a car or send a child to the university.

The President also fulfills his promise to seniors. The bill offers an extra deduction of $ 6,000 for seniors, what will mean That 88% of seniors who receive income from social security do not pay tax on their social security benefits.

The only large great account also does not codify any tax on tips and no tax on overtime payments – both policy that has been designed to provide financial exemption to the American working class. These tax benefits will ensure that main street workers retain more of their hard -earned income. And they will strengthen productivity by rewarding Americans who work extra hours. All Americans can learn how President Trump’s tax cuts will affect their lives for the better A new calculator from the White House.

These productivity-promoting measures are decreasing to the second booster in the Blue Belly: providing 100% costs for new factories and existing factories that expand the activities, plus the deductibility of car loan to support Made-In-America.

Economic security is national security. This became especially clear during Covid, which exposed striking vulnerabilities in our critical supply chains. By offering 100% costs for factories – when supplementing to re -balancing trade to encourage greater domestic production – President Trump enriches our supply chains and the awakening of the power of the industrial basis of America.

To help feed this effort, the President unleashes American energy by removing heavy regulations, increasing the sale of oil and gas lease, elimining the perverse subsidies from the green new scam and re-filling the strategic petroleum reserve. These measures will make life more affordable for American families by reducing the costs of gas and electricity throughout the country.

Click here for more the opinion of Fox News

President Trump follows a bottom-up approach to restore the economy through one big account. To this end, the bill makes the tax cuts of 2017 permanent to give companies of all size the certainty they need to grow, hire and plan for the long term. It also offers targeted lighting for small companies by more than doubling the limit on the total number of small companies that are expressed. These tax provisions will reduce billions of dollars in the hands of the American owners of small companies, which they can then use to expand their workforce and breathe new life into Main Street.

The intention of all these policy measures – whether they are tax cuts for the working class, complete expenditures for manufacturers or new diversions for small companies – is the same: improving the lives of Americans on every sports of the economic ladder. With visionary leadership, President Trump lays the foundation for the Golden Age that he promised through tax deals, trade agreements, peace agreements and deregulation.

Click here to get the Fox News app

The only big great account will make America affordable again. It will confirm the blue-collar boom, the American production reassignments and the commercial potential of the largest economy in the world. Today the passage of the largest tax reduction in history marks the employees of our nation. It is a tribute to the founders who themselves demanded lower taxes and the perfect way is to start the 250 -year anniversary of America.

Click here to Van Scott Bessent