Stay informed of free updates

Traders increase their bets at the reduction of the American interest rate after Jay Powell leaves the Federal Reserve next year, because the chief of the central bank is confronted with a barrage of criticism from Donald Trump to move the loan costs too slowly.

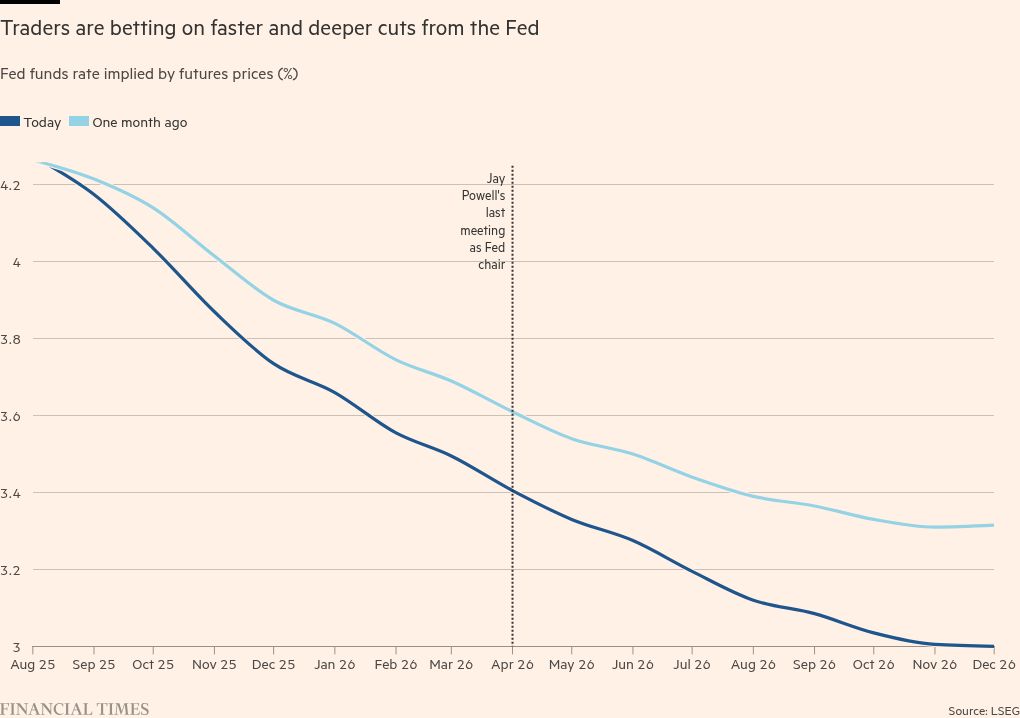

Markets expect by the end of next year at least five quarter-point loss, according to the Futures prices, compared to four a maximum of one month ago. The change in expectations is partly due to speed letters that dampen their view of the inflationary effects of rates. But analysts say that it also reflects the constant Harang of Powell by the president as “Mr Too Late”, who has fueled expectations, he will appoint a more Dovish successor.

“The more striking shift in the past month is priced in cuts for the middle of next year, because the market seems to be increasingly anticipating continuous relaxation as soon as the next FED chairman is in force,” wrote Matthew Raskin, head of US Taries Research at Deutsche Bank in a recent note to customers.

Trump said on Wednesday in a position about Truth Social that he had limited his search for the next FED chair to “three or four people”. He added: “I mean [Powell] Goes out pretty quickly, luckily, because I think he is terrible. “

Treasury Secretary Scott Bessent and Kevin Warssh, who served as a Fed Gouverneur during the 2008 financial crisis, is generally considered one of the forerunners for the job. The fed Governor Christopher Waller, who already endorsed a rate reduction in July this week, will also be considered.

“I think the prevailing market is wisdom that the person who replaces Powell will be more Dovish. It does not mean that they will not respond to the reality of the economy, but they can be more susceptible [lowering rates]”Ian Lyngen, head of the American strategy at BMO Capital Markets.

Although candidates such as Warssh have been historically more unhearted than Dovish, Lyngen said that this could change in the current environment.

He said: “Trump has been extremely critical of Powell. The people who are being considered are currently an audition for the job. To look at earlier performance and to allocate this to future performance is not good in this case.”

In recent months, expectations have mounted that the FED can designate a “Shadow President” prior to the end of the term of Powell that could indicate a more Dovish direction at the rates. The White House said that a decision about the replacement of Powell was not “threatening”.

Comments from FED policy makers have also fired the expectations of faster cuts. Governor Michelle Bowman came to Waller this week and said that she already supports cutting percentages in July, with reference to lower than expected inflation.

The two-year and five-year treasury yields, which are sensitive to expectations, reached two months lows this week, while investors had the possibility of more speed reductions in the medium term.

But Powell has pushed back against the possibility of a July reduction and has not responded to the repeated requirements of Trump, largely because of the inflation risks. During a speech in the congress on Tuesday, Powell said that the cutbacks were off the table to the fall, because the central bank expected the consequences of Trump’s rates on prices in June and July.

The inflation of the consumer price accelerated somewhat to a percentage of 2.4 percent in May, although the increase was smaller than economists had predicted.