Unlock the Editor’s Digest for free

The Federal Reserve left interest rates unchanged for the first time since July, as Chairman Jay Powell said the US central bank was in no rush to cut rates despite Donald Trump’s relentless campaign to drastically cut borrowing costs.

The Fed left its key interest rate at a range of 3.5 to 3.75 percent on Wednesday, after three consecutive quarter-point cuts. The decision was in line with Wall Street expectations.

Powell said after the meeting that with the economy growing at a robust pace and the labor market stabilizing in recent months, interest rates do not appear to be in “significantly restrictive” territory.

“The economy has once again surprised us with its strength, and not for the first time,” Powell said. He said inflation had performed “roughly as expected” and that labor market data suggested “evidence of stabilisation”.

Official statistics released last week show annualized GDP growth of 4.4 percent in the third quarter of 2025. The Atlanta Fed has said this growth could reach 5.4 percent in the fourth quarter.

Powell’s comments represent one of the clearest signals yet that policymakers plan to leave rates unchanged in the coming months, despite Trump’s insistence that they must cut borrowing costs to boost growth. The president has called Powell an “idiot” for not lowering rates.

“If people were looking for a sign that this is a short-term lull, it’s not — and I think that’s the key takeaway,” said Brett Ryan, senior U.S. economist at Deutsche Bank. “This is not a change to a slower pace of cuts. They won’t move for a while unless something forces them to.”

Wall Street’s reaction to the Fed’s decision was modest. Investors continue to expect another cut this summer at the earliest, according to trading in Fed Funds futures.

The US dollar index, which measures the currency against a basket of six rivals, climbed to session highs, rising 0.4 percent on the day.

Two-year Treasury yields, which move with interest rate expectations, rose to session highs after Powell began speaking but remained well within recent ranges. The S&P 500 was roughly flat.

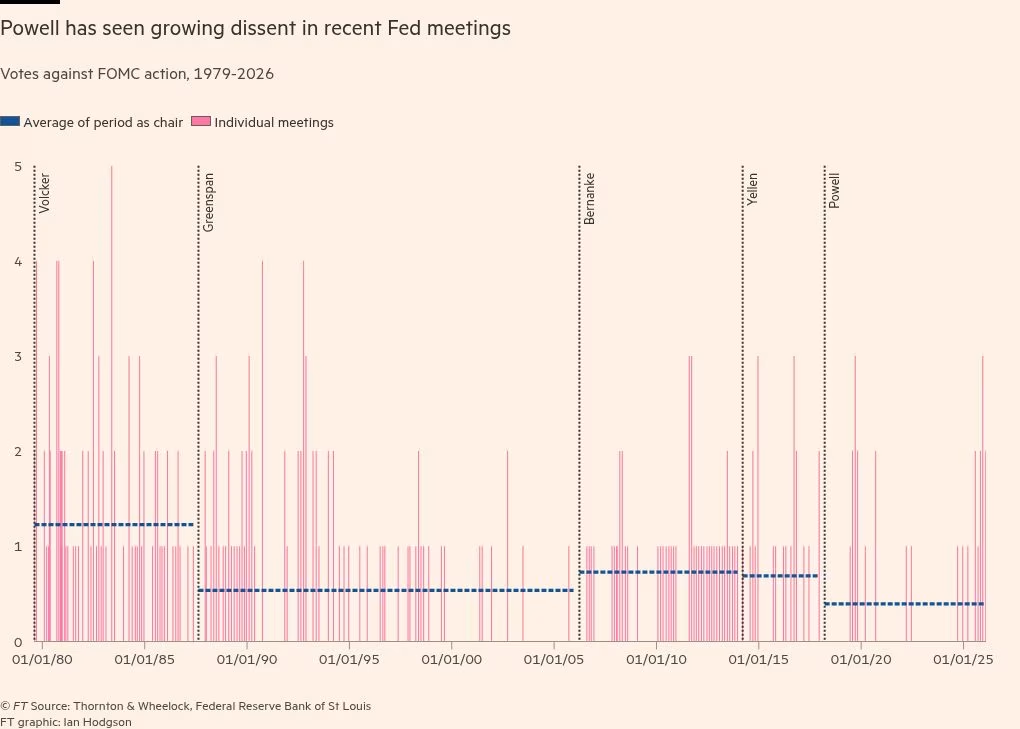

Powell said there was “broad” support within the central bank’s policy-setting board for keeping rates stable.

However, Governor Christopher Waller, one of four candidates remaining in the race to replace Powell as chairman when his term ends in May, disagreed and called for a quarter-point cut. Stephen Miran, a staunch Trump ally who was appointed governor last year, also called for a quarter-point cut.

The objections came as central bankers tried to balance their dual mandates of price stability and full employment. The Fed’s favorite inflation gauge for personal consumption expenditures recorded 2.8 percent in November, well above the 2 percent target.

At the same time, the labor market is showing some signs of weakness, with the world’s largest economy adding just 50,000 jobs last month and long-term unemployment at its highest level in four years.

Powell also emphasized the importance of the Fed’s independence on Wednesday, after revealing earlier this month that the Justice Department had opened an investigation into his handling of a $2.5 billion renovation of the central bank’s headquarters.

He declined to comment on the investigation but defended the importance of the central bank’s independence.

“It would be difficult to restore the credibility of the institution if people lost confidence that you make decisions only based on our assessment of what is best for everyone.”

Powell also defended his decision to attend a Supreme Court hearing on Trump’s attempt to unseat Governor Lisa Cook.

“I would say this case may be the most important legal case in the Fed’s 113-year history.”