Fanatics Betting & Gaming CEO Matt King discusses Superbowl betting, a commercial partnership with Kendall Jenner and more about ‘The Claman Countdown.’

Players they will take the field for Superbowl LX on Sunday will face a significant tax bill due to the game’s location that gives rise to what’s known as a “jock tax.”

Super Bowl LX is being played in Santa Clara, California, and the Golden State is one of a number of states that have a so-called jock tax on professional athletes, with taxes imposed on players based on the number of days they play or practice in a particular jurisdiction, including those outside their home state.

The NFL’s collective bargaining agreement determines the bonuses paid to players on both the winning and losing sides of the Super Bowl: Players on the winning team each receive a payday of $178,000, while players on the losing team get $103,000.

SPORTSBOOK FANATICS SEES BIG BREAK IN DOWNLOADS OF KENDALL JENNER’S VIRAL SUPER BOWL AD CAMPAIGN

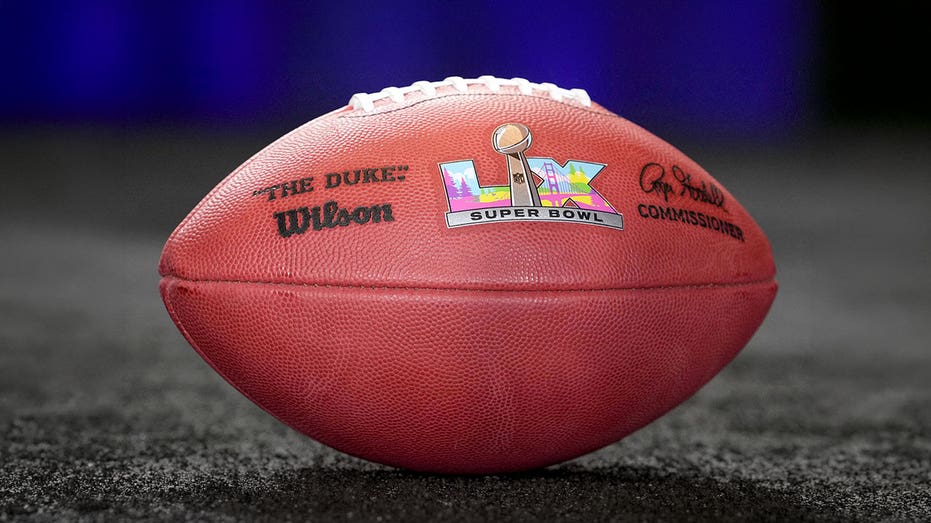

Super Bowl LX airs on February 8 from Levi’s Stadium in California. (Kirby Lee-Imagn images via Reuters)

“What that means here is that the winning team’s net pay will be about $86,000. If you’re on the losing side, the net pay would be about $49,800,” Degner said.

Jock taxes apply NFL players throughout the season in the jurisdictions in which they are in effect, so every time they play or practice in an area where a jock tax has been implemented, they are subject to the tax on the income earned that day.

‘SUPER BOWL BREAKFAST’ RETURNS WITH FOCUS ON LEADERSHIP AND LEGACY FOR NFL SHOWCASE

Super Bowl LX will be held at Levi’s Stadium in Santa Clara, California, triggering the state tax. (Ishika Samant/Getty Images)

Both states and cities can implement jock taxes, complicating the player’s tax burden, although they remain more popular at the state level than in municipalities.

Most jock taxes are implemented using a “duty day” standard, as other frameworks have faced both court challenges and feasibility issues.

SOUTHWEST DEBUTS NEW SUPER BOWL ADS, SHOWING ITS ‘SELF-AWARENESS’ HUMOR

Super Bowl winners take home bigger bonuses than players on the losing team, who still receive a sizable check. (Timothy A. Clary/AFP via Getty Images)

The service day The format uses the number of days an athlete spends “on duty” playing a game, practicing, participating in team meetings, travel days and – in the case of the Super Bowl – fulfilling team-related media obligations.

Total earnings are multiplied by the ratio of the number of days of service spent in a given jurisdiction to the athlete’s total number of days of service to determine the jock tax liability.

“Days of service include days where you practice or, in the case of the Super Bowl, even media day counts as a day of service and if that activity takes place in California, you are subject to those tax rules,” Degner said.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“The players have a very complex tax situation where they could have ten or more different states that they need to file taxes for,” he said. “This is why it is very important for many of these young players that teams put them in touch with sharp financial advisors and tax advisors so that they don’t lose their shirt, so to speak.”