Unlock the Digest of the editor for free

When the US imposed a rate of 25 percent on imported Japanese cars, the expectation was higher sticker prices for American consumers and decreasing turnover. The assumption was that the extra costs for exporters would inevitably be passed on the line. But months after the policy, the outcome has proved much less dramatic.

The American sale of Japanese car manufacturers have shown surprising resilience. Toyota, for example, reached a global sales record in May, with the sale of North America more than a tenth. Part of it is thanks to their local American production.

Behind the stable sales figures, export data tells a more disturbing story. In May the number of vehicles sent to the US fell by only 3.9 percent, according to official data. When the export value is divided by the number of units sold, the average price per vehicle falls to around ¥ 3.5 million, or $ 24,000, about one fifth less than the previous year. According to the total value, the export from the Japanese vehicle to the US fell by almost a quarter.

If the costs of the rates were passed on to the consumer by increasing prices, the export volumes would probably have fallen. But the export value would have been kept stable, which reflects the higher costs per unit. Instead, both volume and value have fallen. This suggests that car manufacturers themselves absorb a large part of the tariff burden.

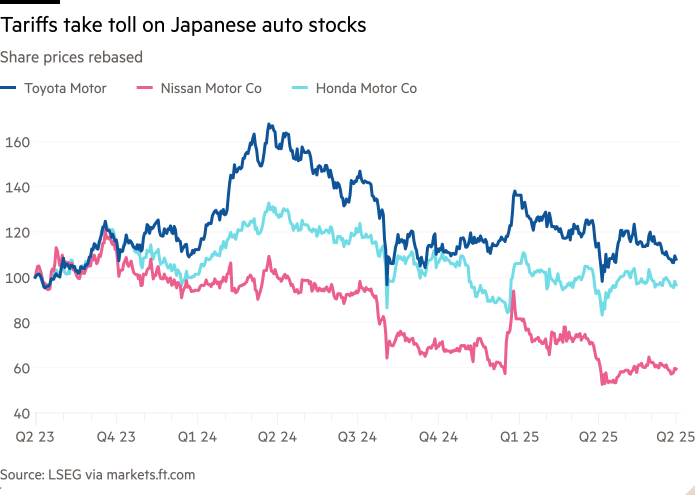

This can be an effective short -term strategy. The US remains the most lucrative market for Japanese car manufacturers. Even modest price increases the risk that the market share undermines, because the companies are confronted with aggressive competition from American and South Korean rivals. For companies such as Toyota, Honda and Nissan, prices can keep their long -term positioning in the country.

But commercial negotiations have emerged, with the seventh round of conversations and little sign of resolution last week. If, as commercial data suggests, companies indeed absorb most of the tariff burden, their margins will come under the growing pressure. That will even be financially resilient groups such as Toyota, which have consistently reported margins above 10 percent since 2023.

When choosing not to increase the prices in order to fully compensate rates, car manufacturers have delayed the disruption, while gambling that politicians will conclude an agreement before the profit is dry. But as the main trade negotiator of Japan Ryosei Akazawa has noticed, some local automaker managers now estimate the losses of a maximum of $ 1 million per hour below the current tariff structure.

Japan will have to act before losing reaches the point where exports are no longer viable. This may mean that more American energy or agricultural products are purchased, or that market access makes concessions in areas such as food safety and medicines. Discipline of his car manufacturers has bought time, but their resilience will soon be put to the test.