Unlock the Digest of the editor for free

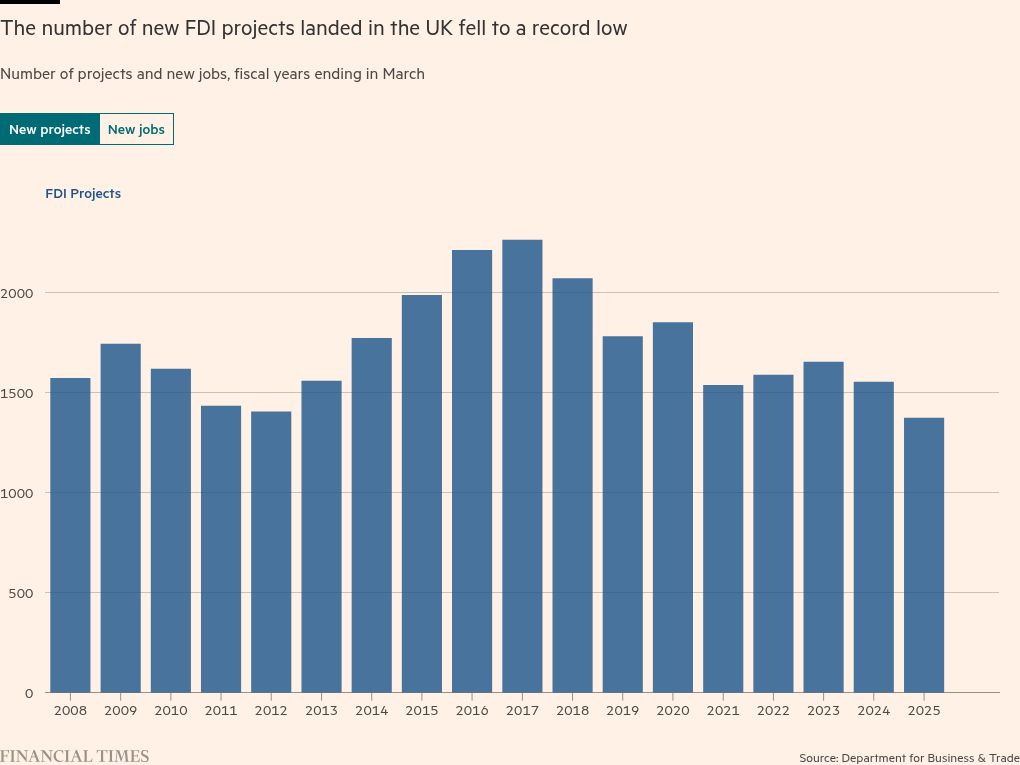

The number of foreign direct investment projects in the UK has fallen at the lowest level since the records started 18 years ago, which emphasizes the challenge that the government is confronted with, because it tries to revive the overseas interest in Great Britain and raise growth.

In the financial year ending in March, 1,375 BDI projects ended up in the UK, according to facts Published by the Department for Business and Trade on Thursday.

The figure fell by 12 percent compared to the previous year and the lowest since the records started in 2007-08.

Experts pointed to persistent problems such as high energy costs and geopolitical uncertainty as key factors behind the decline.

The constant decline in the inner investment is “a worrying sign for the UK,” said Nigel Driffield, professor of international companies at the Warwick Business School, adding that “high energy prices and constant global uncertainty have weakened global DBI streams”.

He said that it illustrated the need for the newly released industrial strategy, and noted that “although the new reset will help with the EU”, the United Kingdom in line with the block “was too late for these figures”.

Foreign investments are an important engine for growth in productivity and standard of living, but the number of new projects fell by almost 40 percent compared to the peak of 2,265 in the 2016-17 financial year.

The industrial strategy of Labor, a 10-year plan to increase business investments and to stimulate strategic growth sectors, aimed at lowering difficult electricity prices for manufacturers and supported advanced production and clean energy industry.

The government did not publish the value of new DBI projects, but estimated that jobs created via BDI fell by 3 percent decreased to 69,355, in the tax year until 2024-25.

The number was the lowest since 2020-21, when strict COVID-19 Pandemic limitations were imposed.

The decrease in direct foreign investments in 2024-25 “will be disappointing for the government, given its ambition to attract more foreign capital,” said Andrew Wisart, economist at the Berenberg Investment Bank.

He noticed a “tension” between the growth ambitions of Labor and the recent cost pressure on employers, such as the increase in the contribution of the national insurance of the employers, who came into effect from the beginning of April.

Other European countries also have difficulty attracting investments, according to the honorary European attractiveness questionnaire published earlier in June.

It showed that “weak economic growth, geopolitical turbulence and continuous high energy prices” ensured that foreign direct investments in Europe fell to a low year at nine years in 2024, with decreases for all largest economies.

London attracted 31 percent of all British new projects, showed the DBT data, despite a decrease of 15 percent on an annual basis. Scotland, Wales and Noord -Ireland, on the other hand, are all registered increases.

But there were widespread falls between sectors and countries of origin. The US, the largest investor in the country, generated 13 percent less BDI projects than in the previous year.

IT and Financial Services, the two largest sectors for DBI, registered a decrease of 2.3 percent and 5 percent on an annual basis of new projects, with falls in life sciences, biotechnology and pharmaceutical products

Joe Marshall, Chief Executive of the National Center for Universities and Business, said: “The latest data is mainly concerning in high -quality, strategically important sectors.”