Unlock the Digest of the editor for free

The Mexican peso has emerged as an unlikely winner from the trade war of Donald Trump, because the fading of global risks and repeated delays to American rates are luring investors back to the high -productive assets of the country.

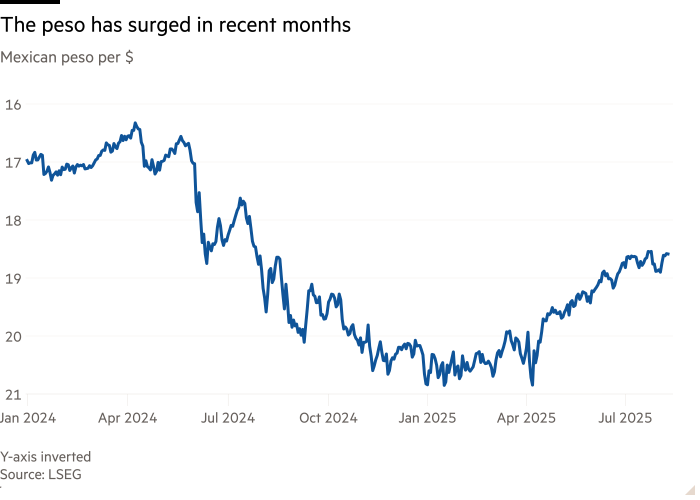

The currency was one of the great, early victims of Trump’s trade attack and weakened to no less than 21 pesos for the US dollar in amazing trade at the beginning of February after the announcement of 25 percent American rates on Mexico who were subsequently postponed.

Since then, it has gathered to the Greenback to just over 18.5, more than erasing his losses since the Trump elections, because investors benefit from silence in market volatility and positive trading developments to stack in high -bounds Mexican assets. The peso has risen by 4 percent in the last three months, which means that it is the best performing of a basket with strongly traded currency followed by Bloomberg.

“Mexico is given the American relationship negotiations a little better than others,” said Derek Halpenny, head of the global market research at Banking Group MUFG.

Mexico and Canada have better trade conditions with the US than most other countries thanks to an exemption for goods that comply with the US-Mexico-Canada Trade agreement USMCA, which means that the vast majority of their exports are released from rates. On July 31, Mexico insured an extension of 90 days at the so-called mutual rates of Trump for non-exempt goods, while Canada did not. The Canadian dollar has only won 1.1 percent in the last three months.

The increase in the peso and in other currencies such as the Brazilian Real, an increase of 3.7 percent in the past three months, has been fed by a revival of the so -called carrier trade, whereby investors are borrowing where interest rates are relatively low to buy assets where the rates are higher.

Mexican assets, supported by a policy percentage of the central bank of 7.75 percent, are an important beneficiary.

“The power of the Mexican peso and Mexican assets in general is mainly driven by the weak dollar environment and high carry,” said Thierry Larose, emerging market manager at Vontobel, an investment group. In Brazil, the Real has tax problems and American trade tensions of US trade in the same way, he added.

Currency analysts said that a decrease in volatility had revived the wear trade. A CME group index of expected fluctuations in the exchange rate of the Dollar peso has fallen steeply from his peak in November and last month the lowest levels since May last year, a decrease in the implicit volatility that was also seen in other currencies.

“The wear trade has been very popular since the volatility levels be started,” says Chris Turner, head of market research at Bank ING.

Fund managers said Mexico benefited from a stream of capital back in emerging markets, which contributed to the premium that develops developing countries to borrow above the return on developed bonds for developed countries to the lowest since 2007.

Ten -year -old Mexican debts have been collected since the beginning of the year and pushes his return to 9 percent, compared to 4.3 percent on comparable American treasury.

Viktor Szabo, a fund manager at Aberdeen, said that a mixture of slow growth and “well -worn” core inflation had stimulated Mexican debts, which also benefits from the “very strong tail wind” of dollar wake.

“American trade policy remains a source of short -term risk,” he added. “But worries are somewhat limited by Trump’s frequent Up bends about the most harmful policy.”

President Claudia Sheinbaum’s government has been in conversation about a new safety pact with the Trump government to try to weaken the violent drug cartels of Mexico. But a large number of risks, including the threat of one -sided military intervention by the US hanging over the bilateral relationship.

Vontobel is somewhat underweight Mexican assets in the conviction that markets underestimate some of the more unmanageable problems with which the government of Sheinbaum is confronted, such as the debts of Pemex, argued the state of oil company, Larose argued. But especially for American rates, given widespread exemptions, “the threats are probably a bit exaggerated,” he said.