The IMF report is good news in the circumstances. It’s all relative! Although it is under intensive abuse by the armies of Russian President Vladimir Putin, the economy of Ukraine is robust, the policy is good and provides improvements in public finances and his reforms on schedule. So far, so impressive.

The analysis indicates that the own program of the IMF – for $ 15.5 billion in financial aid for four years – is also on schedule, just like the $ 153 billion financing package that is part of, which includes much larger contributions from the EU, the US (until this year) and other Ukrainine friends. About $ 40 billion a year in “financing needs”, which this coalition has been able to offer so far and must continue to foresee, even if the US abandons Ukraine.

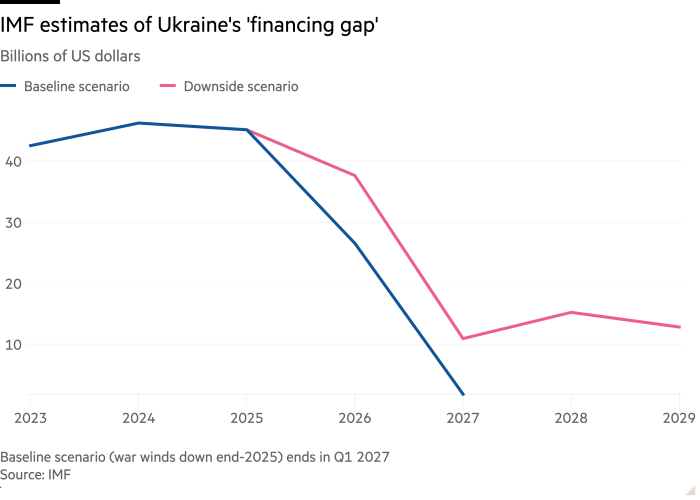

But “financing needs” of $ 40 billion a year does not mean that Ukraine only needs (alone!) $ 40 billion a year. Timothy Ash, a financial analyst, has one fair angry blog post About how the IMF analysis runs the risk of hiding a larger and more disturbing truth. Ash makes the following observations. Firstly, the total number of help from Western countries is Ukraine, including military kit, in the order of $ 100 billion a year, according to the excellent of the Kiel Institute Ukraine Support Tracker. Secondly, even that is only enough to allow Kyiv to keep fighting, not to win the war. Thirdly, the calculations of the IMF are based on the war that ends at the end of 2025, or mid -2026 in a downward scenario. That is why financing needs will rapidly fall to negligible amounts in the IMF analysis from 2026.

ASH speculates that it would take $ 150 billion a year, instead of $ 100 billion, to bring Ukraine into a sufficiently dominant position to defeat the Russian invaders. Who knows? But it is clearly much more than what is now given to Ukraine, so that it can hold the line but no longer. Ash is therefore undoubtedly correct that the IMF figures can give an incorrect impression that the financial needs of Ukraine are relatively modest, so manageable. This enables Western Technocrats to say that Ukraine is for the time being “fully financed”, which in turn distracts Western political leaders from the reality of what they have to do.

In fact, it is worse than that: if the financial support of West Lowballs for Ukraine, the war will take longer than what is assumed in the more reassuring analysis, leaders and the public for a annoying surprise.

There are understandable, although bad, reasons why the IMF number is what it is. One is that “financing needs” means something else for technical economists than to most people: it roughly refers to how many new loans you have to undertake in view of your projected expenses, existing resources (including free military kit) and debts to service. It does not represent an objective or realistic measure of how much Ukraine is actually ‘needed’ in a sensible non-technical sense. Another is that the IMF cannot legally borrow to a program that does not add, so the day that the analysis of the analysis of unfulfilled financing needs would be the day that it should pull the plug. That would be worse than a misleading song.

There are several other important observations about the Ukrainian economy and public finances; Some good, some bad. The good news first: the Ukrainian government is getting better in increasing resources (tax and other income) in their own country. This is noticed by the IMF and is also worn in the Last “fiscal digest” from the KYIV School of Economics. In the first quarter of this year, tax income exceeded the objective of the government considerably, partly thanks to policy improvements (but also inflation). The bad news: more and more of the budget is going to defense-related expenditure-and this is another reason to think that the above needs are too optimistic while social expenses are pressed.

And yet there is something remarkably resilient about the economic activity of the country. We hear a lot about how the Russian economy performs better than expected (much of them exaggerated). But look at the Ukrainian economy! A large part of GDP was chased in 2022, as a result of the large areas that were occupied and millions of refugees had to flee. But since then, Ukraine has been plowed ahead. The IMF registered and predicted growth at 5.5 percent in 2023, on or almost 3 percent in the next two years, and almost 5 percent again in 2026 and 2027.

That is very favorable to compare with Russia. Ukrainian inflation is no worse than that of Russia, while it is Interest rates in the central bank are lower. Although unemployment is high – partly a function of KYIV that decides to save his youngest men from the horrors of the front line.

But all in all, the growth performance of Ukraine has closed that from Russia since 2022, and if the predictions of the IMF are good, the cumulative growth until 2030 will be more than twice that of the country that it has attacked.

Another way to look at this is the better investment. A American dollar -based investor who bought a share of the Ukrainian GDP in 2022 would have achieved a cumulative return of 27 percent nomulal dollars this year, against a nominal dollar loss of 10 percent on a share in the Russian GDP. For comparison, the figure for the GDP of the US is 17 percent. If we believe that the IMFs are predicting 2030, the cumulative nominal dollar drivers are 74 percent, 4 percent and 43 percent by that time. Ukraine is worth setting up money.

However, all this is precarious. Ukraine is struggling to attract capital; It is largely forced to borrow from the EU. Even for the snake numbers of the IMF, a continuous debt restructuring must be successfully completed. Also, Ukraine may not be left on the hook-such as the legally IS-for the “extraordinary acceleration” (ERA) loans that are supported by profit on blocked Russian central banking reserves, which run the risk of going back to Russia with every six months extension of the EU sancties. As far as the real economy is concerned, growth clearly depends on the war, but the IMF and the KSE also warn that the end of the generous trade access to the EU and the loss of access to the Black Sea Various Route would give the economy a bad knock.

So how much does Ukraine need? Ash is right to say that it needs enough to win the war, and his gamble of $ 150 billion a year is almost every year. The kse, meanwhile, estimates That capital of $ 300 billion more than ten years will be needed from abroad for “investments needed to guarantee productivity improvements and robust economic growth”.

But here is how you think about it: the total amounts depend over how quickly Ukraine can end the war against the conditions to his advantage – and that in turn depends on how much money the country is being given now. Ash has a striking calculation of the back-of-the-envelope that compared the $ 100 billion in two years that it could take to help Ukraine win with the extra amounts that European governments promise to defend due to the threat that an undefeated Russia has now seen to form:

Now consider the costs of our non -financing Ukraine to win – the strategy that we have followed for the past 3.5 years. This is that the West still has to figure out $ 100 billion a year, but now we hear that the European NATO has to increase its defense expenditure from 2% of GDP to 3.5% and then 5% ultimately. Every 1% of GDP -Extra European NATO defense expenditure is $ 300 billion, so twice the annual costs of financing Ukraine to win and beat the Russian threat. If we ultimately increase European defense expenditure to 5% of GDP, that is a $ 750 billion, to annual defense issues. Are we actually idiots? So we can increase financing to Ukraine by $ 50 billion a year for two years to beat Russia, or we can spend an extra $ 750 billion a year in the coming years.

And I think so underestimate The cost-benefit difference. A victorious Ukraine would be a flourishing Ukraine (KSE provides a growth of 7 percent in 2027 when the war ended). And this would benefit Western countries through smaller charges on their taxpayers and profit teeth for their investors who bring reconstruction capital to Ukraine. An reported Ukraine, or even someone who suffers this war that sweated in the same way, would not offer these economic opportunities.

And then there is my long-term bugbear: the failure of the West to bear the blocked foreign exchange reserves of Russia-Ongeveer $ 300 billion-over to Ukraine as a down payment to the compensation that Moscow clearly owes for his destruction. There is only one alternative to give this to Ukraine, namely to finally return it to Russia, and for Western (now mostly European) taxpayers to meet the financing needs of Ukraine instead.

A highly placed EU diplomat tells me that it is unlikely that there will be a renewed debate at the top of the EU institutions about the transfer of these assets, unless there are new unfulfilled financing needs for Ukraine. What I have written above suggests that such a moment of settlement could sooner come later.

Other readable

● Brace for the new age of financial repression and a hurry for the investment capital of the world.

● Fantasies of the far right.

● The US dollar has had its worst achievements since 1973 in the first six months of the year.

● Pilita Clark explains how climate risk can cause the next major financial crisis.