Welcome back. The White House has been busy trumpeting the first 12 months of its “America First” agenda.

US President Donald Trump outlined “365 victories in 365 days” on Tuesday to mark the first anniversary of his second inauguration, repeating these apparent first-year successes in a speech in Davos.

Commerce Secretary Howard Lutnick also wrote an op-ed in the FT. He argued that the old, globalist system “left working people behind,” that the Trump administration’s new approach is to “rebuild domestic manufacturing” and “restore the idea that… economic policy should serve American citizens.”

How did the US president’s second attempt to “Make America Great Again” go? In this edition I will investigate.

With Lutnick’s emphasis, I’ll focus on how working people, industry and, in general, American citizens have fared over the past year.

Since January 2025, there have been 584,000 additional jobs in the US. Last year, average weekly real earnings continued to rise to record highs, excluding the pandemic.

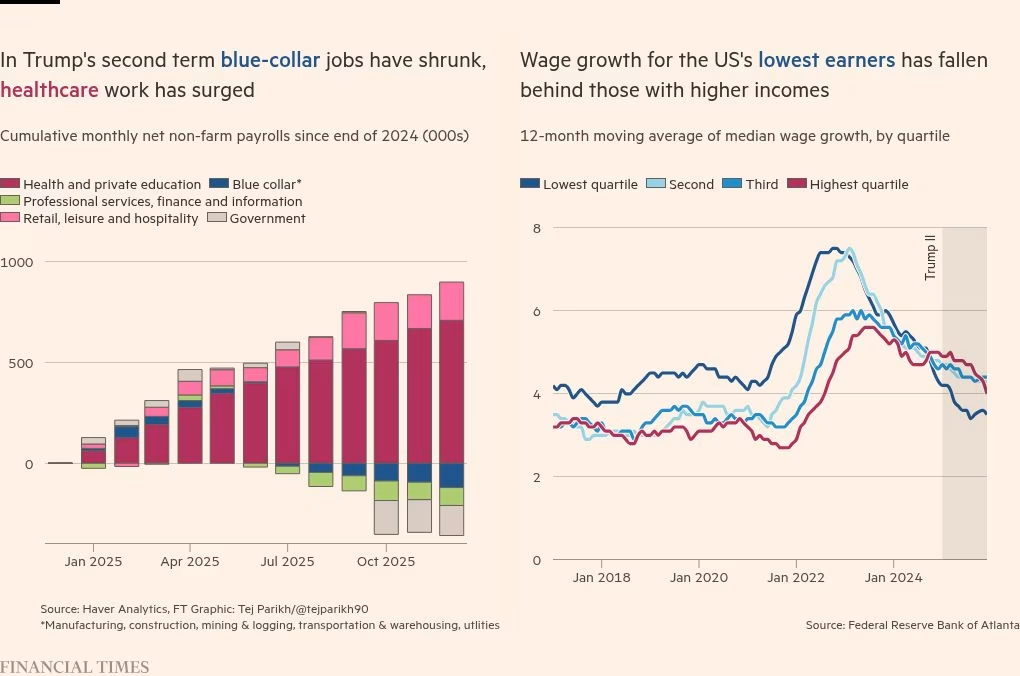

But these aggregates are misleading. First, more than 700,000 jobs have been created in healthcare and private education. Labor, which the White House most associates with “working people,” has fared poorly.

There are now 68,000 fewer manufacturing jobs than before the start of Trump’s second term. Overall employment in the manual sectors, including manufacturing, construction, transportation, logging and utilities, has shrunk.

The administration’s crackdown on illegal immigration also has not led to clear gains for U.S.-born individuals, as Trump suggested.

“Over the past 12 months, the unemployment rate has risen among native-born workers and fallen slightly among foreign-born workers,” said Jed Kolko, senior fellow at the Peterson Institute for International Economics.

“Foreign and native workers don’t simply compete for a set number of jobs. When companies can’t get the workers they need, they sometimes cut production and let other workers go.”

The lowest-paid American workers are also suffering a sharper slowdown in wage growth than their wealthier counterparts.

A rise in annual inflation due to the introduction of tariffs has put further pressure on the lowest earners. Data from Harvard Business School’s Pricing Lab shows that the cost of the cheapest U.S. imports has risen more than premium items over the past year.

Concerns about the cost of living, which helped Trump defeat Democrats in the 2024 US elections, appear to have only increased under his administration.

According to the University of Michigan Survey of Consumers, a greater share of households, across all income cohorts, report higher prices as a problem today than before the start of the president’s second term.

Household spending remains resilient, but is built on shaky foundations. The savings rate as a share of disposable income fell last year to the lowest level since 2008, excluding the years of the pandemic. Total credit card debt also reached $1.2 trillion in the third quarter, a record high. The share of balances due to serious delinquency has risen to the highest level in fourteen years.

After the White House victory lap, the people most closely associated with Trump’s “America First” message — blue-collar workers and the lowest earners — have had a difficult year.

There is also no evidence of a renaissance in American manufacturing, notes Scott Lincicome, vice president of the Cato Institute.

“Overall activity in the sector has contracted over the past ten months, based on the ISM Manufacturing PMI index,” he says. “Inventories are still historically high and occupancy rates are also weak.”

Although Trump claimed in his Davos speech that U.S. factory construction was “up 41 percent,” the annual number of new private manufacturing buildings fell in 2025 after peaking the year before, according to official data.

In terms of jobs, manufacturers have shrunk their payrolls every month since May.

The decline is related to tariffs, which have increased input costs. “Lutnick’s comments are disconnected from reality. Attempts to isolate US producers from the rest of the world with tariffs are hurting the industry,” Lincicome added. “The American manufacturing industry is still very global.”

The National Association of Manufacturers estimated last year that 91 percent of U.S. manufacturers use imports to make things.

When it comes to ensuring that policies serve Americans, it appears that the White House agenda has thus far served some citizens better than others.

Tariffs are a regressive tax. The Congressional Budget Office also estimates that households in the lowest income deciles would suffer net losses over the next decade as a result of the tax, credit, and transfer decisions in the One Big Beautiful Bill Act. The highest cohorts are expected to benefit the most.

Then there’s the AI investment boom, which the government has fueled through tariff cuts, deregulation and various deals. It helped push the S&P 500 to a record high last year, while AI-related investments contributed about 39 percent of total U.S. GDP growth in the first nine months of 2025, based on research from the St. Louis Federal Reserve.

Technology activity has supported the stock ownership of all Americans. But companies in the sector have benefited disproportionately, especially the financiers of Silicon Valley and Wall Street, and the already wealthy. Consumer confidence and the S&P 500 moved in opposite directions last year.

Research from Bridgewater, an asset manager, suggests that it is unlikely that a significant portion of chipmakers’ profits will be recycled back into the economy.

“The labor required to build or operate data centers is quite small relative to the dollars in capital expenditures,” the report said. “In fact, AI investments risk creating negative pressure on the labor market as the sheer amount of financing required drives up the cost of capital, creating headwinds for other, more interest-rate-sensitive sectors.”

The result is that labor’s share of U.S. GDP fell significantly in the third quarter to its lowest level ever. For a government built on reshoring and worker-oriented rhetoric, that’s a difficult statistic.

Perhaps it is too early to judge the White House project. The president has also belatedly acknowledged concerns about affordability.

But Matt Gertken, chief strategist at BCA Research, notes that Trump’s approval on the economy — the biggest issue for voters — is declining and may be difficult to reverse.

“The K-shaped economy is not a winning strategy, and the president’s efforts to ease monetary and fiscal policy are facing legal challenges and a near-gridlock in Congress. The administration has limited tools other than rate cuts to lift those at the bottom,” he says.

The U.S. Supreme Court could soon rule that most of last year’s tariffs were illegal and order a refund, which could provide a boost.

Yet the story of the first 365 days is largely a story of the US economy showing resilience despite the “America First” agenda, not because of it. If the first 12 months of the second Trump administration are to be a reflection of its new economic model, that’s not a very good advertisement.

Food for thought

Can GIFs shared on social media platforms predict stock market returns? This research paper discovers.

Free Sunday Lunch is published by Harvey Nriapia