Welcome back. Companies and investors are sensitive to developments in the taring agenda of Donald Trump. After all, since the import duties directly influence the profit margins and supply chains, their economic impact feels tangible and threatening.

But there is another part of the American president’s policy plans that could be just as important – if not – for the largest economy in the world: his immigration – performance.

A remarkable decrease in foreign employees in America “represents a much more sustainable negative supply shock for the economy than rates,” says George Saravelos, head of FX Research at Deutsche Bank. “But immigration judge less the attention of the market, because the passage to economic activity takes longer and is more difficult to control.”

So this week I will find out why Trump’s immigration policy could indeed be the US economy more than its rates.

At the moment there are three strands for the president’s immigration agenda. “The first is the closing of illegal and legal crossings along the border between the US and Mexico,” says Alex Nowrasteh, vice-president of the Cato Institute. “The second is increasing deportations from the interior by empowering immigration and customs enforcement. And finally, reducing legal immigration by terminating refugee programs, reducing student visa, setting country berths and the obstacles to obtaining visa.”

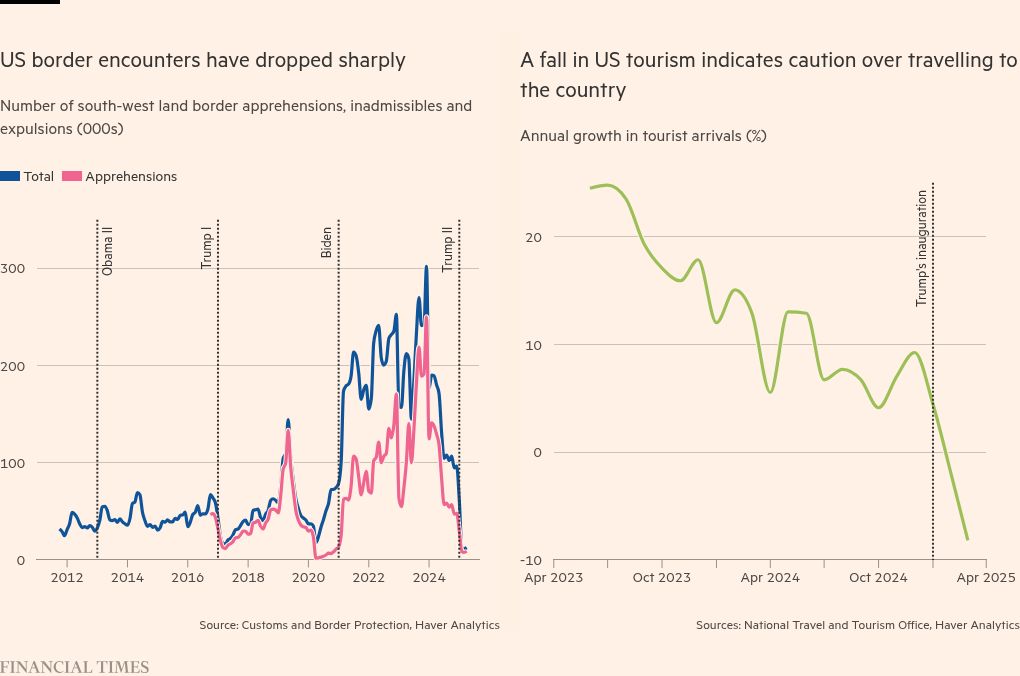

All three pillars are now taking effect. Migrants encounters on the southwestern country border have fallen into lows that have not been seen since the 1960s. According to ICE, there were an average of 2,000 arrests per day in the first week of June, compared to just over 300 a day in the tax year of 2024 under the BIDEN administration.

In addition to the disruption last month for interviews with student visa, universities and research agencies are threatened with financing reductions of the White House. Indeed, in March, three -quarters From postdoctoral researchers and PhD students who have answered a poll for the journal Nature, said they considered leaving the US.

A recent decrease in the arrivals of tourists is also an indication of the general caution for traveling condition.

Trump’s plans have led economists to lower their projections for American immigration. An upcoming study of the Brookings Institution and American Enterprise Institute is expected to project negative Immigration to the country this year.

That did not happen in at least half a century of data. This will be powered by fewer arrivals, in addition to deportations and voluntary outputs, the researchers say.

Evercore Isi expects that net immigration will remain negative even after this year. Although there is a remarkable uncertainty about its assumptions, the company banking company thinks that the foreign population of America could fall by around 500,000 a year in the coming three years.

That is before Trump’s policy is paid with regard to universities and student visa. “The increased risk of seeing applications rejected or visa withdrawn can prevent students from choosing the US,” says Marco Casiraghi, a director of the company. “Like less financing for research.”

This is an important problem for the US economy, because its recent growth depends on work born abroad.

The American labor market has been “supplied” since the COVID-19 Pandemie, partly due to “surplus retirement,” explains Dhaval Joshi, a main strategist at BCA Research. “Strong growth in the labor supply-driven by immigration-in a economy limited by the chairman explains why the American GDP has grown faster than most expected in recent years,” he says.

Indeed, the impressive growth in American jobs after the pandemic is powered by foreign employees.

The American population would shrink without immigration. “America is today an aging, sub-permit-multility society, and the indigenous population in the working age is no longer growing,” says Nicholas Eberstadt, a political economist at the AEI.

The degree of participation under the professional population born in the US has stagnated in recent years and remains under pre-Pandemic levels.

This means that lower immigration will drag the annual potential growth rate of the country, in particular below the recent level of 2 percent. For a measure, Morgan Stanley expects it to fall to 1.5 percent in 2026, while Trump’s policy reduces the hours worked in the entire.

Simply put, the loss of foreign employees is similar to removing an economic input. (By increasing production costs, rates mainly affect how inputs are used.)

It would make the US extra dependent on generating considerable productivity gain, for example of artificial intelligence, to support its growth.

Foreign employees have an extra impact on the economic growth potential of America, outside their direct range of labor.

There were an estimated 8.3 million unauthorized employees in the US in 2022, accounting for around 5 percent of the American workforce, according to the Pew Research Center.

These employees tend to support core industries where there are existing shortages, including construction, agriculture and production. In some practical professions, such as brick masonry and roofing, which use a large proportion of workers without papers, the labor -saving technologies are still limited. After taxes, according to the American Immigration Council, this group also has more than $ 250 billion in annual fine.

For these reasons, “Deporting employees … Reduces jobs for other American employees,” notes the Peterson Institute for International Economics in a Recent Study. Even in the “low” scenario of the think tank, with the expulsion of 1.3 million unauthorized employees, the American GDP finds 1.2 percent below the basic line in 2028. The loss of employment provision also penetrates inflation.

Higher trained foreign employees play a more important economic role in stimulating the productivity of the US through innovation and business.

Despite the fact that about 5 percent of the American workforce, highly skilled immigrants include a larger part of the labor pool in industries that require advanced education and specialized experience, says Goldman Sachs in a recent research memorandum. These include information services, semiconductor design, scientific research and medicines.

Nber research Estimate that American immigrants founded a fifth of the start-ups of venture capital between 1990 and 2019. A quarter of the total economic value created by patents in companies between 1990 and 2016 also came from employees born abroad.

There is of course a lot of uncertainty about how Trump’s immigration policy will take place. Analysts expect the administration to be inadequate at its promises of ‘massive deportation’ – which could mean that we focus 1 million deportations per year – given the logistical challenges. Very skilled employees and students cannot be able to find suitable opportunities abroad in the short term.

Still, protrusion Projections from Evercore Isi, Brookings and AEI for net immigration to become negative, at least in the short term, will generate worse results for the US economy in the long term than rates.

For a measure, assuming that Trump’s immigration agenda only amounted to the low-end deportation scenario of the PIIE, the real GDP would still fall further from the basic line compared to its different tariff plans.

This result can feel counter -intuitively. This is partly because markets and companies are so focused on the directness and bottom-line consequences of rates. But tariff and immigration shocks spread through the economy through different channels.

Rates are a tax on importers. In the short term, they stimulate prices and weaken the question by increasing uncertainty. Over time SAP they deliver by moving coddling and sources to, less efficient companies.

But reducing foreign employees is more related to the direct removal of resources, as well as a source of demand and innovation, of the economy. It just takes a little longer to filter.

Rates – and their effects – are probably also less permanent than a hit for employment.

Future administrations can lower or remove all import duties. They can also reduce immigration barriers (although politics can be more difficult). But in general, trade flows and supply chains respond more to changes in policy, costs and economic circumstances than drawing flows, at least in the short term.

This means that as soon as part of the labor force has been reduced, it is not easy to scale it back quickly. Chance employees, students and unauthorized immigrants can remain a risk -to bind Trump in the US for a while after the second term of Trump.

In the long term, it is the loss of people from abroad – and not the costs of external goods – that will be much more harmful to the prosperity of America.

Food to Thougent

Why do people follow rules, even if they get stimuli not to do this? A New study Finds conformism an important factor.

Free lunch on Sunday is edited by Harvey Nriapia