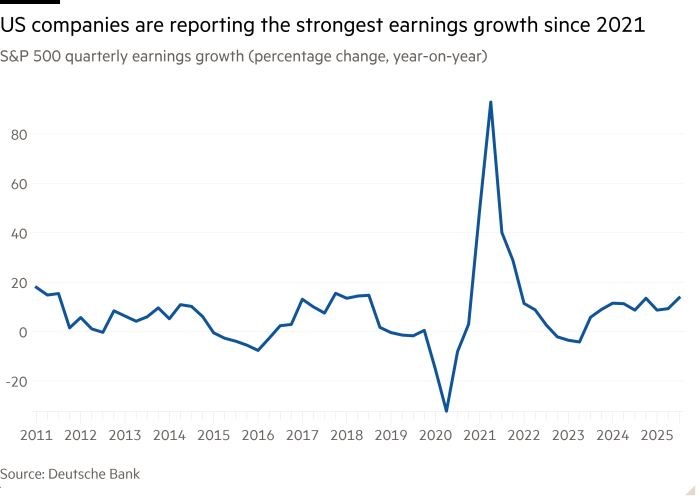

U.S. companies’ profits are growing at the fastest pace in four years, defying predictions that President Donald Trump’s trade war would cause a slowdown in American business.

The average annualized earnings growth of the Russell 3000 index – a benchmark for the entire US stock market – was 11 percent in the third quarter, compared with 6 percent in the previous three months, according to Morgan Stanley. That is the fastest growth rate since the third quarter of 2021.

Six of the 11 sectors that make up the benchmark S&P 500 index reported positive average earnings growth in the three months through September, according to Deutsche Bank analysts, compared with just two sectors – financials and mega-cap tech stocks – between April and June.

The strong growth comes despite warnings earlier this year from executives that Trump’s sweeping tariffs would drive up costs, hit supply chains and threaten economic growth.

“Companies have found ways to cushion the impact of tariffs and consumers will continue to spend as long as they have a job,” said Dec Mullarkey, managing director at SLC Management, which manages $300 billion in assets.

Goldman Sachs equity strategist David Kostin said the vast majority of S&P 500 companies have reported their third-quarter earnings and the year-to-date results are above consensus analyst forecasts and are among the highest ever.

“In our 25-year data history, this frequency of earnings surprises has only been surpassed during the 2020-2021 Covid reopening period,” he wrote in a note to clients this week.

According to data provider FactSet, analysts expect fourth-quarter profits to grow 7.5 percent.

Business sentiment has been helped by trade deals with Japan and the EU, with Trump and Chinese leader Xi Jinping agreeing a one-year trade truce last month.

Automakers Ford and General Motors have said they expect a smaller tariff increase as a result of the Trump administration’s expanded stimulus for imported auto parts.

Energy companies, real estate groups and industrial companies are also showing strong revenue growth and expanding margins. NRG Energy benefited from data center construction and improved travel demand boosted Southwest Airlines.

Banks including Goldman Sachs, Citigroup and JPMorgan Chase have posted huge gains, helped by a revival in dealmaking activity and strong trading income thanks to volatility in financial markets.

Despite Meta disappointing the market with hefty investment plans, Big Tech groups such as Alphabet, aided by Google’s search and advertising businesses, and Microsoft achieved results that exceeded analyst expectations.

However, warnings from some consumer-facing companies suggest many Americans are struggling, analysts say.

The CEO of packaged foods group Kraft Heinz labeled consumer confidence over the Christmas period as “one of the worst” in decades, while burger chain McDonald’s said customers had withdrawn from its more expensive offerings.

Companies that sell goods instead of services “are clearly the laggards this earnings season,” Deutsche analysts said, with “consumption-oriented companies” underperforming those that sell mainly to other companies.

The lack of official employment data due to the US government shutdown has increased investor uncertainty about the state of the labor market and consumer health.

Alternative data sources, including the National Federation of Independent Business, the San Francisco Federal Reserve and state-level unemployment benefits, show that the labor market is “still doing well,” said Torsten Sløk, chief economist at investment firm Apollo Global Management.

That’s despite significant layoffs by major companies recently, with at least 17 S&P 500 groups, including Amazon, UPS and Target, losing about 80,000 jobs since early September, according to Goldman Sachs.

The University of Michigan’s consumer confidence index fell to a three-year low in November. The decline in confidence “was widespread across the population by age, income and political affiliation,” said Joanne Hsu, director of the study.

There was “one significant exception,” Hsu added: sentiment among consumers with large stock holdings rose 11 percent.

Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management, said a “wider divide” between the “haves” and the “have-nots” explained why consumer demand appeared resilient despite the weakening labor market.

The top 40 percent of households, as measured by income, “control nearly 85 percent of America’s wealth, two-thirds of which is directly tied to the stock market, which has risen more than 90 percent in three years,” she said.

As a result, predicting the labor market may become less and less important than predicting the direction of the stock market itself in understanding consumption levels.